Traditionally, grandparent-owned accounts hurt a scholar’s fiscal help ability even more, even though The foundations are altering to the 2024-2025 award and not call for grandparents to report their fiscal aid.

View all investmentsStocksFundsBondsReal estate and choice investmentsCryptocurrencyEmployee equityBrokerage accounts529 higher education savings plansInvestment account reviewsCompare online brokerages

After you acknowledge your loan supply, you are able to be expecting to obtain your hard earned money within just one business enterprise working day of clearing verifications. You should definitely Examine your email or Up grade dashboard for virtually any doc requests, considering that we might request sure files to confirm your id prior to finalizing the loan.

Earnings grow point out money tax-free – For Pennsylvania taxpayers, earnings expand tax-deferred and so are free of charge from Pennsylvania state earnings tax when useful for skilled schooling expenditures.

A tough inquiry, generally known as a tough credit rating pull, is exactly what many people imagine every time they think about a credit history inquiry.

C., and also some instructional establishments. When you’re not limited to using the 529 approach provided by your state of home, there may be Advantages to picking it, such as point out tax deductions or credits.

How often can I roll above into my account? You may roll around money for the same beneficiary just once per twelve consecutive thirty day period period of time. When you change the beneficiary to your family member of the current beneficiary, on the other hand, there isn't any Restrict on how frequently you'll be able to roll above an account. Am i able to roll above A further 529 account into my PA 529 account? You'll be able to roll more than money out of your existing 529 account into a PA 529 prepare by 1st opening a PA 529 account and completing the Incoming Rollover Variety for the right Pennsylvania strategy. PA 529 will then request the funds from one other program. In case you have previously shut your other account, you may mail the proceeds with the rollover having a duplicate of your respective Enrollment Form along with a breakdown of your principal and earnings on the rollover. A rollover from a non-PA 529 account into a PA 529 account, if finished inside the regulations and obtained by PA 529 inside 60 days from the withdrawal, won't be taxed by Pennsylvania or maybe the federal federal government at some time with the rollover. Once the account is made use of, the normal rules governing withdrawals would use. You ought to check with the other intend to see if they cost any penalties for rolling resources out in their account to another 529 program. For out-of-point out people and for Individuals who have Formerly finished rollovers for the same beneficiary, you must Look at together with your tax advisor For added factors. On top of that, an quantity rolled in excess of from One more 529 plan can not be deducted from taxable money for Pennsylvania taxpayers, as most other contributions is usually. How do I roll around a UTMA/UGMA account into my PA 529 account? You could roll around resources from an existing UTMA/UGMA account into an current PA 529 account, but it is necessary to note which the PA 529 account will then have the extra restrictions relevant to your UTMA/UGMA account. A further choice is to open up a next PA 529 account solely for that UTMA/UGMA rollover. By trying to keep UTMA/UGMA and other contributions in separate accounts, the restrictions on UTMA/UGMA would not implement to funds within the non-UTMA/UGMA 529 account. You should critique the right disclosure statement as it pertains to UTMA/UGMA accounts before you make this transaction. Can my PA 529 cash be moved to a PA Equipped account? Of course.

Alter the more info “Predicted Withdrawal” setting to “Certainly” and click on “Future”. Confirm your variations and click “Post”. After you have current your scholar’s university of attendance and Enrollment Position, your account is going to be all set to make on-line experienced withdrawal requests or help you obtain a Payment Authorization Form to process a paper request. (Be aware: All requests for experienced withdrawals need to include things like a duplicate of the student’s tuition bill.) How do I entry my account to pay for qualified bigger training charges? When using your PA 529 GSP to pay for increased training, If the student is attending a Pennsylvania publicly funded college, the GSP Tuition Stage might be altered to match the school your college student might be attending.* By ensuring that that your Tuition Level matches the general public university being attended, you make certain that you'll get the account benefit to which you are entitled. For an in depth explanation on the withdrawal approach, see the "Utilizing your Pennsylvania 529 Assured Savings Program Account" webinar, offered listed here. Payments from the PA 529 GSP account might be requested on the web or by mailing or faxing a kind. You could direct payments to your self or the student by ACH debit to your banking account or you could mail payments straight to The college or maybe a third party such as a landlord. For all experienced withdrawals, a replica of the scholar’s itemized tuition Monthly bill is necessary. *Take note: If you are a PA 529 Guaranteed Personal savings Plan account proprietor and decide to use your account to pay for experienced K-twelve expenditures or competent university student loan repayment expenses, you should phone our customer service center at 800-440-4000.

The value of one's investment decision will enhance or lower based upon the general performance within your investments. You'll be able to commonly make use of the personal savings on tuition, costs, and room and board at any college or College.

Go with a beneficiary. Should you’re preserving for your son or daughter’s potential instruction, you’ll enter their name, day of birth and some other aspects the program necessitates.

At NerdWallet, our written content goes via a arduous editorial critique system. We've got these assurance within our exact and practical written content that we Enable outside industry experts inspect our get the job done.

The state tax deduction for Massachusetts taxpayers is usually not as generous as other states’ options supply, but could possibly be worthwhile for specific in-point out citizens.

Anybody can set up a system and add to it. Parents, grandparents and also other relations can all open up and add to the account.

In the event you try this, having said that, you might want to Think about how much money is remaining in the approach for the 2nd (or 3rd) child once it’s been tapped by an before baby.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Seth Green Then & Now!

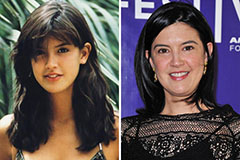

Seth Green Then & Now! Phoebe Cates Then & Now!

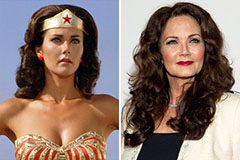

Phoebe Cates Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!